Understanding the Hammer Candlestick Pattern

The Hammer Pattern is a chart pattern in technical analysis that typically appears on the price charts of stocks, forex, or other financial markets.

It is a type of candlestick pattern used by traders to identify potential market reversal signals.

It can be either red (indicating a decline) or green (indicating a rise)

Key Characteristics:

- Small real body at the upper end of the trading range

- Long lower shadow (at least twice the length of the real body)

- Little or no upper shadow

The hammer suggests that sellers drove prices lower during the trading session, but strong buying pressure pushed the price back up by the close, potentially indicating a bullish reversal.

How to Identify Hammer Candlestick Pattern in Python:

Here is a simple code snippet in python, You can adjust the weight parameter; the larger it is, the longer the lower shadow, making the pattern more pronounced.

import pandas as pd

def is_hammer(open, high, low, close):

body = abs(open - close)

weight = 2

wick = min(open, close) - low

return wick >= weight * body and high - max(open, close) <= body

def find_hammers(df):

df['is_hammer'] = df.apply(lambda row: is_hammer(row['Open'], row['High'], row['Low'], row['Close']), axis=1)

return df[df['is_hammer']]

# Example usage

#Assuming df is a DataFrame that contains OHLC data (Open, High, Low, Close prices).

df = pd.read_csv('stock_data.csv')

hammers = find_hammers(df)

print(hammers)

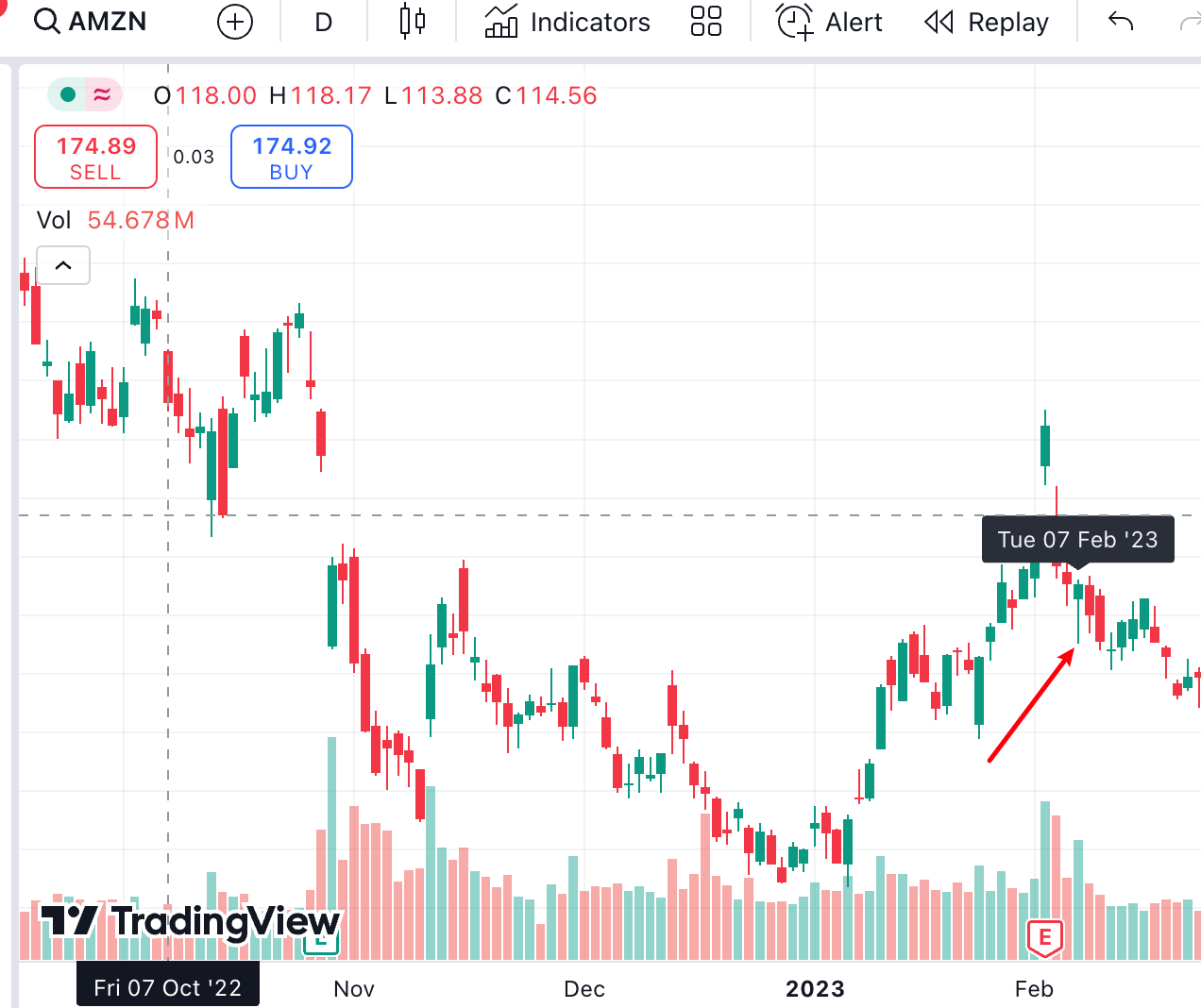

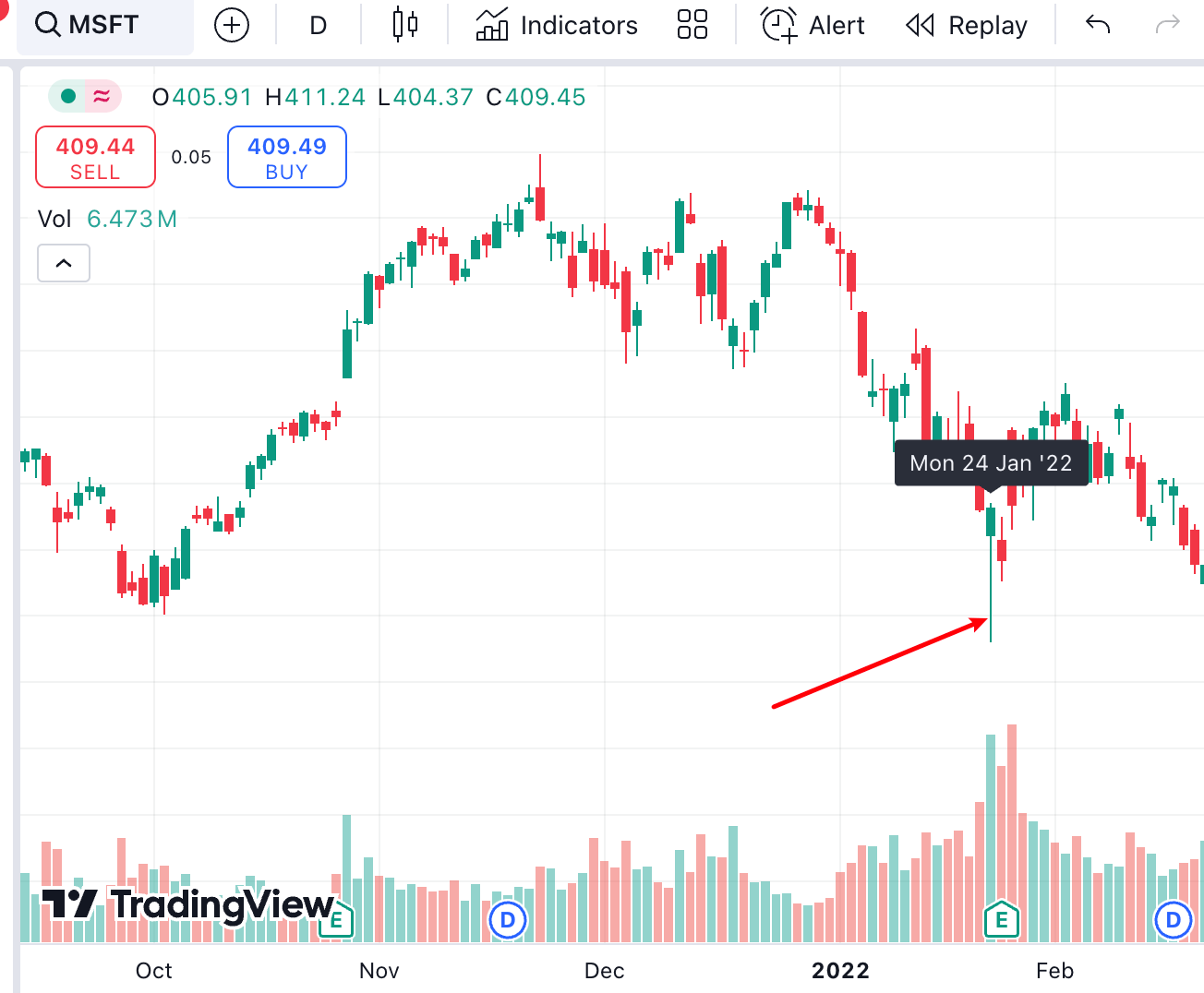

Real Historical Stock Price Chart Example:

Here are several real stock charts featuring hammer patterns that can help you deepen your impression of them.

Conclusion

When a hammer pattern forms in an uptrend, it may signal that the market is testing support, but it doesn't guarantee a trend reversal.

The hammer pattern isn't a foolproof reversal signal on its own. To make a reliable judgment, you should use it alongside other technical indicators and consider market sentiment. The pattern's effectiveness also depends on its position, timing, and how the market behaves afterward..

Hammer Candlestick Pattern Practice Tool Online

You can also use our tool to learn more about candlestick pattern. It includes some classic candlestick patterns, such as the hammer pattern, among others.